Exporters Urged to Avoid Customs Declaration Errors for Compliance

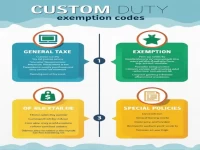

This article delves into common errors in export customs declarations, focusing on price currency, weight, quantity units, final destination country, and duty exemption methods. It provides corresponding compliance strategies to help foreign trade enterprises avoid declaration pitfalls, improve customs clearance efficiency, and reduce trade risks. The guide aims to assist companies in navigating the complexities of export regulations and ensuring accurate and compliant declarations, ultimately minimizing potential delays and penalties.